How to do Futures Trading on Tapbit

In this comprehensive guide, we will walk you through the fundamentals of futures trading on Tapbit, covering key concepts, essential terminology, and step-by-step instructions to help both beginners and experienced traders navigate this exciting market.

How to Trade USDT-M Perpetual Futures on Tapbit (Website)

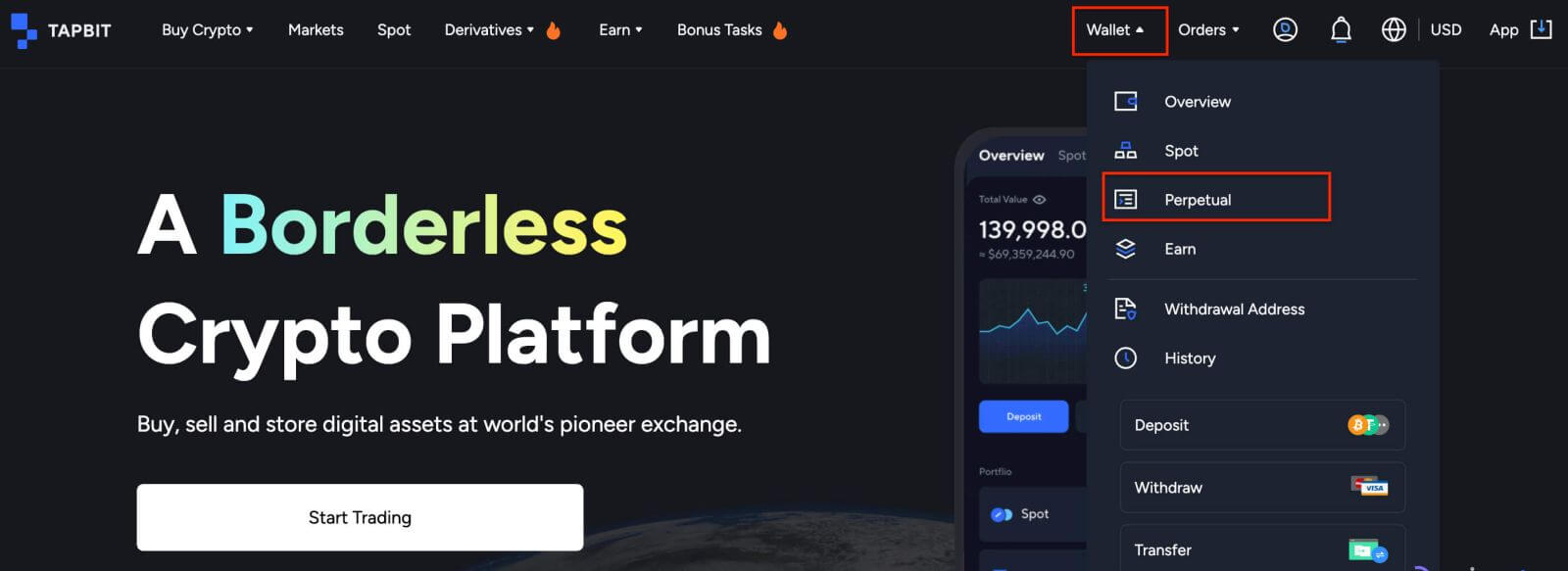

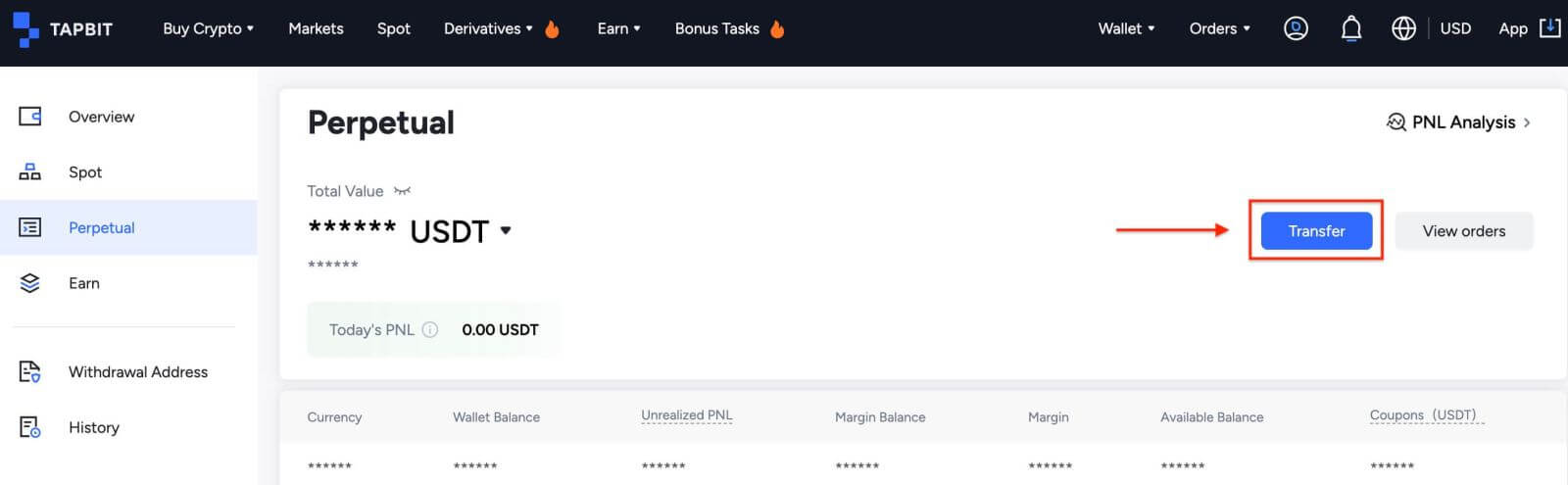

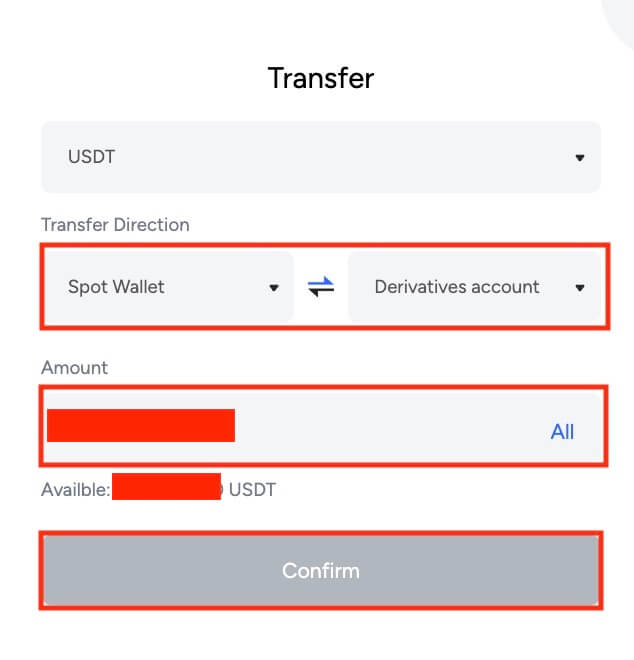

Before engaging in futures trading, it is essential to deposit funds into your futures account. This distinct fund dictates the level of risk you are willing to undertake and influences your trading margins. Keep in mind to only transfer an amount that you are prepared to lose. Futures trading carries higher risk compared to regular cryptocurrency trading, so exercise caution to safeguard your own and your family’s financial stability.Navigate to the trading interface’s right side.

Select "Transfer", enabling you to transfer USDT seamlessly between your spot and Derivatives account.

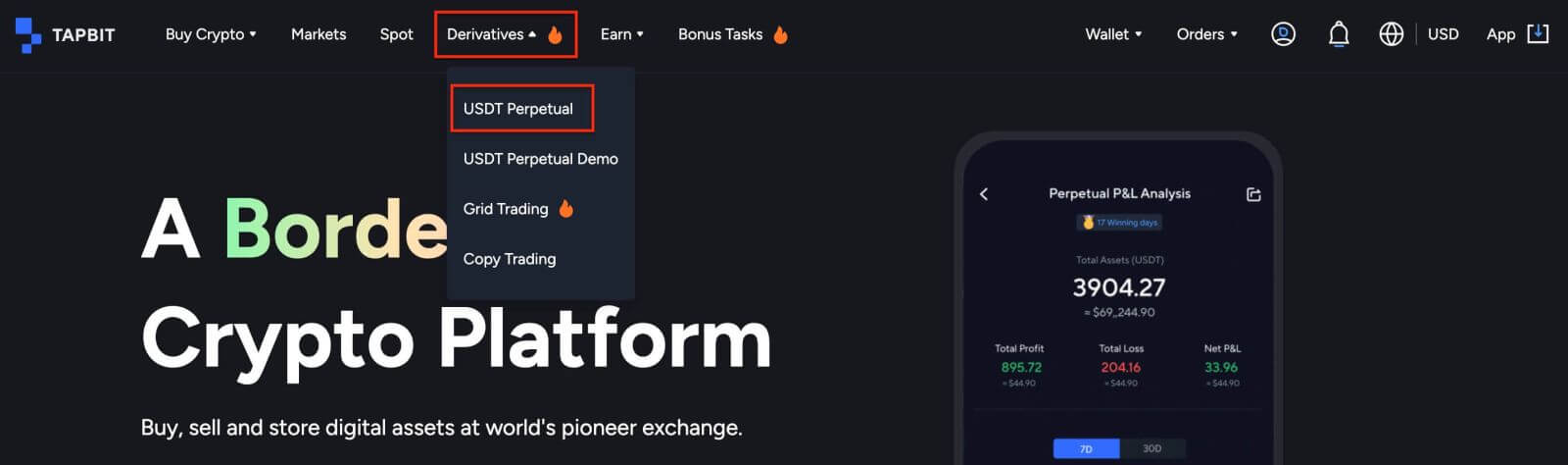

After successfully completing the funding process, you can proceed to open a USDT perpetual contract by clicking on the [Derivatives]-[USDT Perpetual]

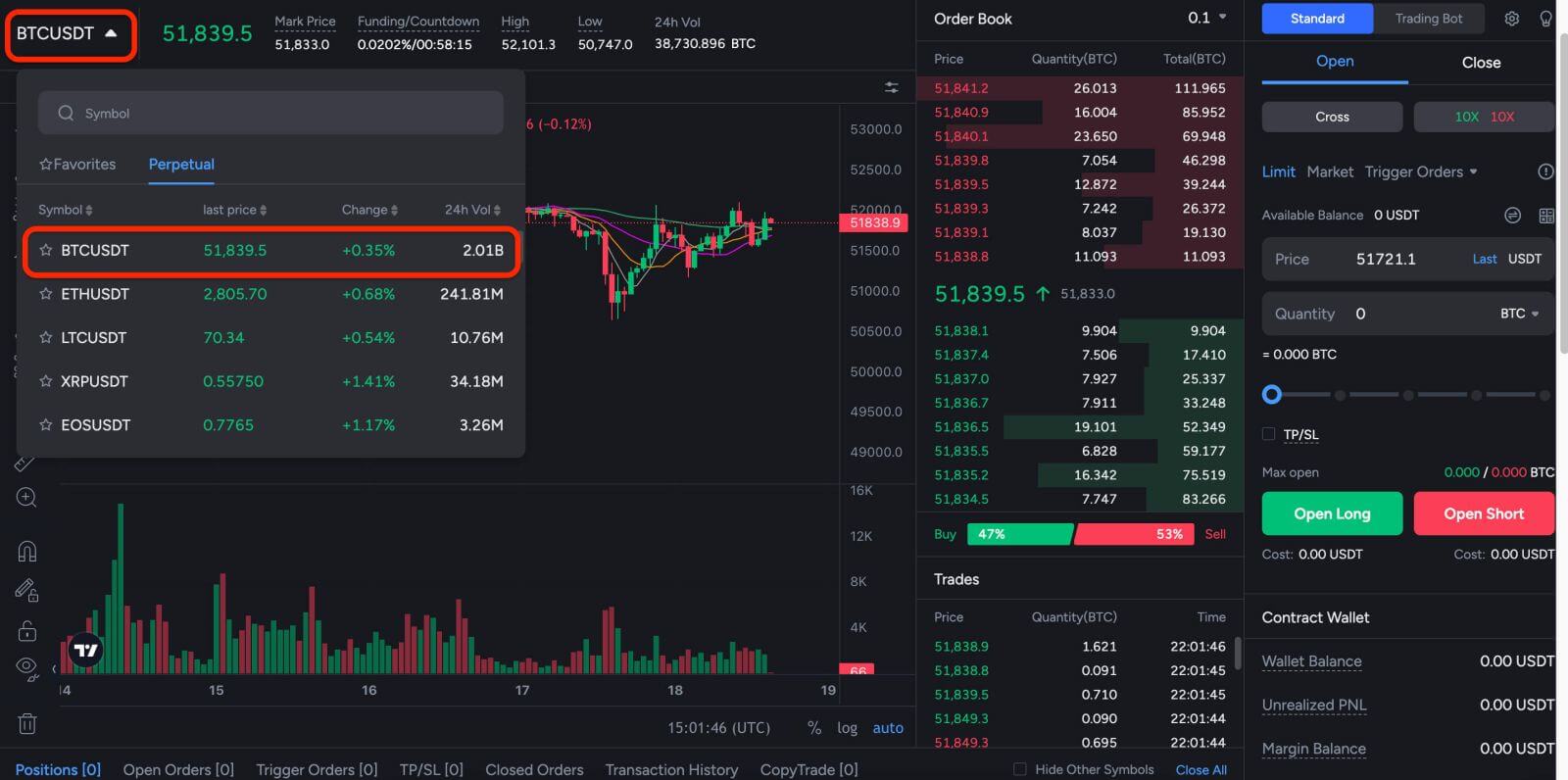

1. On the left-hand side, select BTC/USDT as an example from the list of futures.

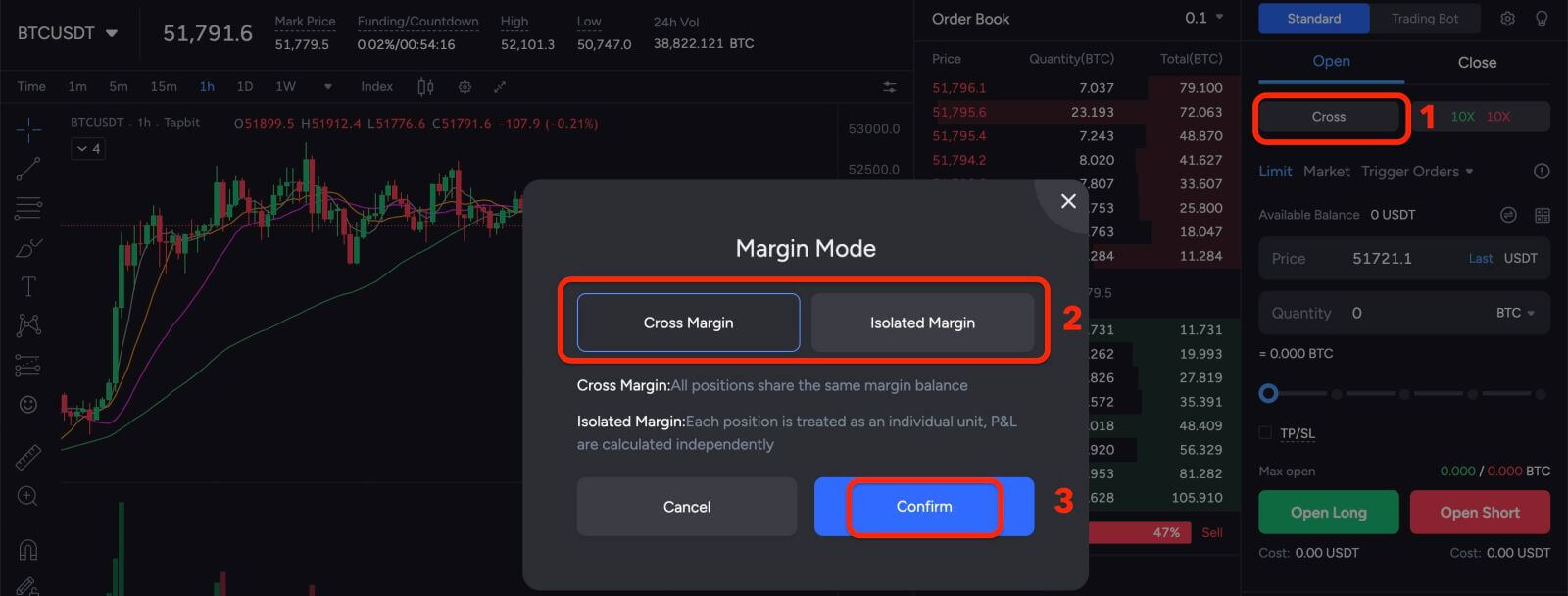

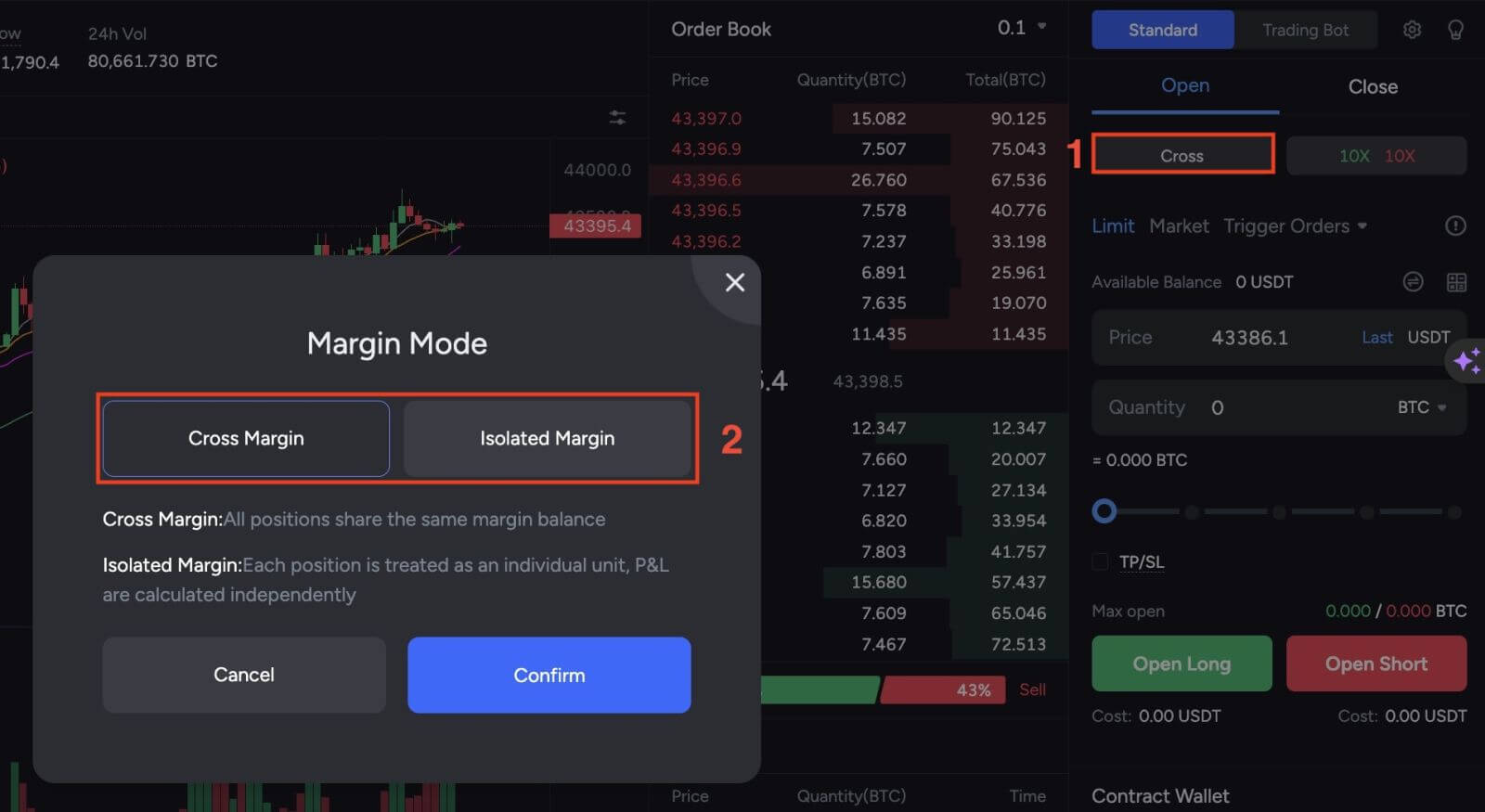

2. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode]. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

3. To open a position, users have some options: Limit Order, Market Order, and Trigger Orders. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

Market Order:

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Trigger Orders:

- Set a trigger price, order price, and order quantity.

- The order will only be placed as a limit order with the predetermined price and quantity when the latest market price hits the trigger price.

- This type of order provides users with more control over their trades and helps automate the process based on market conditions.

7. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

How to Trade USDT-M Perpetual Futures on Tapbit (App)

At the [Derivetives] tab, select [...] icon.

Click [Transfer] to transfer USDT between your spot and Derivatives account.

After successfully completing the funding process, you can proceed to purchase a USDT perpetual contract

1. Tap the [Derivatives] tab. Select your desired coin pair, such as BTC/USDT, located at the top left of the interface.

2. Click on the following part. Here, you can click on Isolated or Cross to choose your [Margin Mode]. After that, click [Confirm] to save your change.

The platform supports traders with different margin preferences by offering different margin modes.

- The Cross Margin: All cross positions under the same margin asset share the same asset cross margin balance. In the event of liquidation, your assets full margin balance along with any remaining open positions under the asset may be forfeited.

- The Isolated Margin: Manage your risk on individual positions by restricting the amount of margin allocated to each. If the margin ratio of a position reached 100%, the position will be liquidated. Margin can be added or removed to positions using this mode.

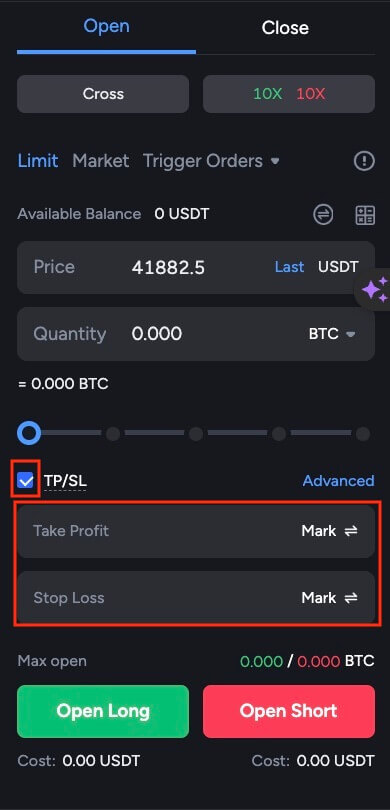

3. To open a position, users have some options: Limit Order, Market Order, and Trigger Orders. Follow these steps:

Limit Order:

- Set your preferred buying or selling price.

- The order will only be executed when the market price reaches the specified level.

- If the market price doesn’t reach the set price, the limit order remains in the order book, awaiting execution.

Market Order:

- This option involves a transaction without specifying a buying or selling price.

- The system executes the transaction based on the latest market price when the order is placed.

- Users only need to input the desired order amount.

Trigger Orders:

- Set a trigger price, order price, and order quantity.

- The order will only be placed as a limit order with the predetermined price and quantity when the latest market price hits the trigger price.

- This type of order provides users with more control over their trades and helps automate the process based on market conditions.

7. After placing your order, view it under [Open Orders] at the bottom of the page. You can cancel orders before they’re filled.

Margin Modes on Tapbit

Margin Mode

Tapbit offers two margin modes: Cross and Isolated.In Cross margin mode, all funds in your futures account, including unrealized profits from other open positions, are utilized as the margin.

Conversely, Isolated mode only uses an initial amount specified by you as the margin.

Tapbit Web:

Tapbit App:

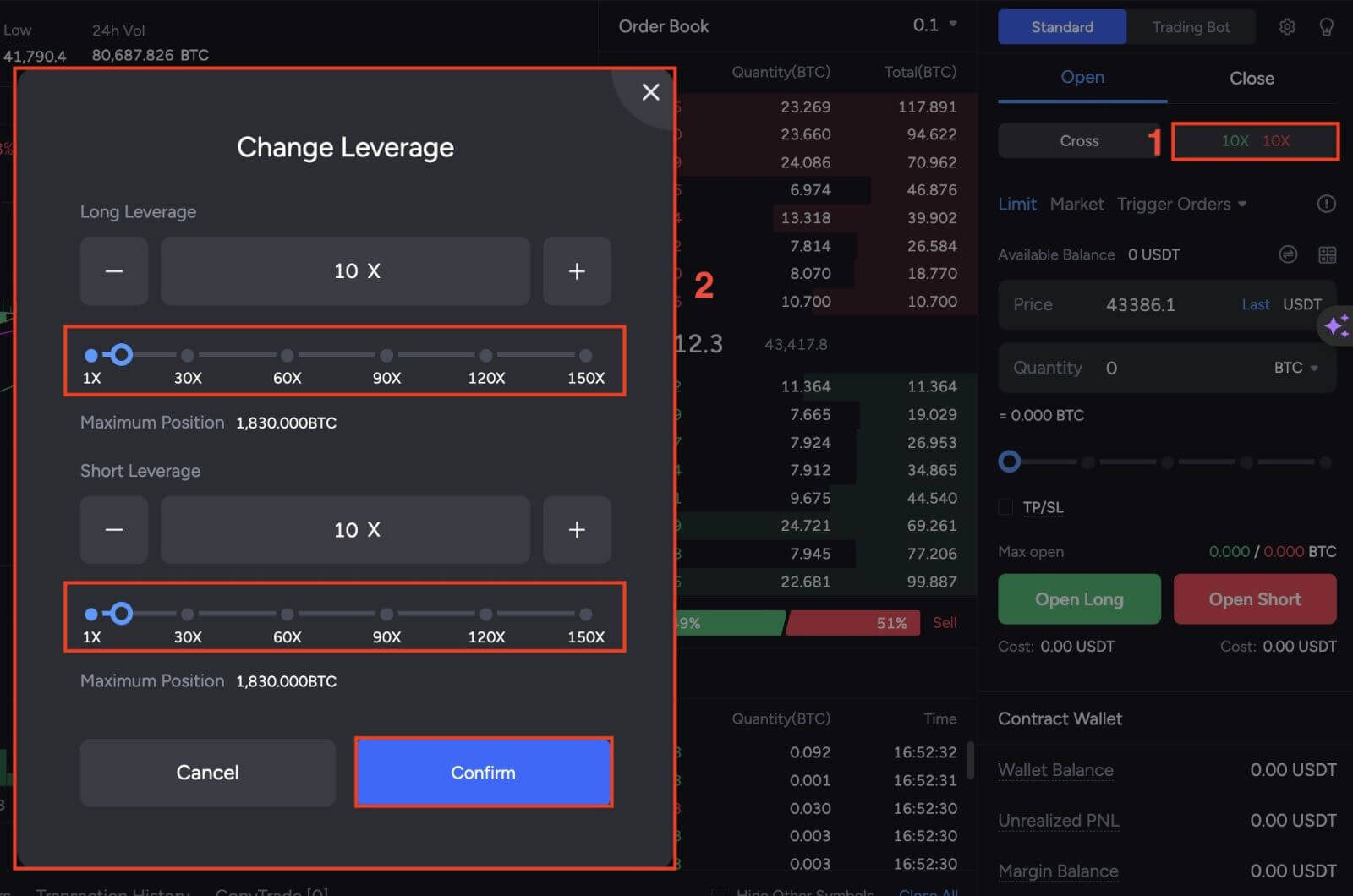

Leverage Multiple

USDT perpetual contracts provide the opportunity to amplify both gains and losses on your positions through leverage. For instance, with a chosen leverage multiple of 3x, if the value of your underlying asset increases by $1, your profit would be $1 * 3 = $3. Conversely, if the asset decreases by $1, your loss would also be $3.The maximum leverage you can use is contingent on the chosen asset and the value of your position. To mitigate substantial losses, larger positions will have access to smaller leverage multiples.

Tapbit Web:

Tapbit App:

Long / Short

In perpetual contracts, unlike traditional spot trading, you have the flexibility to either go long (buy) or go short (sell).Opting for a long position signifies your belief that the value of the purchased asset will increase over time. In this scenario, you stand to profit from the upward movement, with your leverage amplifying these gains. Conversely, if the asset’s value declines, your losses will also be magnified by the leverage.

On the other hand, choosing to go short involves anticipating a decrease in the asset’s value over time. Profits are realized when the value decreases, but losses are incurred when the value rises.

Once you’ve initiated your position, there are several additional new concepts to acquaint yourself with.

Tapbit Web:

Tapbit App:

Some Concepts on Tapbit Futures Trading

Funding Rate

At the top of the trading interface, you will observe a Funding Rate and Countdown timer, a mechanism designed to maintain alignment between contract prices and the underlying asset.When the countdown timer reaches zero, users with open positions are evaluated to determine if they need to pay the specified percentage fee. If the contract price exceeds the current underlying asset’s price, long positions will pay the fee to short position holders. Conversely, if the contract price is below the underlying asset’s price, short positions will pay the fee to long position holders.

Funding fees are collected every 8 hours at 00:00, 08:00, and 16:00 UTC. The fee calculation follows this formula: Fee = Position quantity * Value * Mark price * Capital expense rate. It’s important to note that these transfers occur directly between users, and Tapbit does not collect any of these fees.

Mark Price

The mark price represents a slightly adjusted version of the actual contract price. Although the mark price and the real price typically align with a very small margin of error, the mark price is more resilient to sudden fluctuations and high volatility. This resilience makes it challenging for abnormal or malicious events to impact the price value significantly and trigger unexpected liquidations.The mark price is calculated by finding the median value from the Latest Price, the Reasonable Price, and the Moving Average Price.

- Latest Price = Median (Buy 1, Sell 1, Trade Price)

- Reasonable Price = Index price * (1 + capital rate of the previous period * (time between now and the next charge of funds / collection of funds rate interval))

- Moving Average Price = Index Price + 60-Minute Moving Average (Spread)

- Spread = The exchange’s median price - index price

Ladder Reduction

If a position incurs a loss deemed unacceptable based on the available margin, it may not undergo complete liquidation. Instead, it can be selectively reduced according to a tiered ladder system. This approach safeguards both individual user positions and the overall market health by averting extensive chain reaction liquidations.Partial liquidation of positions will occur in incremental steps until the margin reaches a level compliant with the maintenance margin rate.

The related formulas are as follow:

- Initial margin = Position value / leverage

- Maintenance margin = Position value * Current tiered maintenance margin rate

Maintenance Margin Rate

This refers to the minimum margin rate required to maintain an open position. If the margin rate drops below this maintenance margin rate, Tapbit’s systems will either liquidate or reduce the position.

Take Profit / Stop Loss

Tapbit provides the option to establish automatic price points for selling either the entire position or a portion of it when the mark price of the asset reaches a predetermined value. This feature resembles a Trigger Order commonly utilized in spot trading.After initiating a position, navigate to the Positions tab at the bottom of your trading interface to access details on all open positions. Click on the TP/SL button located on the right to open a window where you can input the specifics of your order.

In the first field, enter the trigger price. Once the mark price of the asset reaches this specified value, your order will be executed. You have the flexibility to sell your asset through limit or market trades, and you can also determine the quantity of your holdings you intend to sell in the order.

For example:

- If you have a long position in BTC/USDT and the opening price is 25,000 USDT,

- If you set a stop-limit order with a trigger price of 30,000 USDT, the system will automatically close the position for you when the marker price reaches 30,000 USDT.

- If you set a stop-loss order with a trigger price of 20,000 USDT, the system will automatically close your position when the marked price reaches 20,000 USDT.